Warsaw, Poland – May 30, 2023 – Medicalgorithmics, SA, a global healthcare technology company leveraging AI to revolutionize medical diagnostics worldwide, announced its financial results for the three months ended March 31, 2023. The company showcased significant, and better than expected progress in executing the new business plan adopted after the acquisition by BioFund of the 49.99% of the company at the end of Q4/2022, including (1) a strategic shift towards software and analytics monetization (resulting in improved growth prospects and strengthened liquidity), and (2) a strategic shift away from former reseller distribution agreements worldwide that used to involve regional exclusivity and impaired growth.

Financial Results Summary:

- Cash, cash equivalents, and short-term investments of PLN 39.0 million, a 33.0 million improvement compared to first quarter 2022.

- Revenue of PLN 11.3 million, a 13% decrease compared to the first quarter 2022, that resulted from (1) a 28% decline in the United States (a necessary initial cost of exiting the previous exclusivity agreements – the anticipated revenue decline, announced with the Medi-Lynx disposal, earlier this year), and (2) a 23% growth outside of the US.

- Gross Margin of 17%, PLN 1.9 million, a 4 percentage points improvement compared to the first quarter of 2022 (13%, PLN 1.6 million)

Operational Highlights:

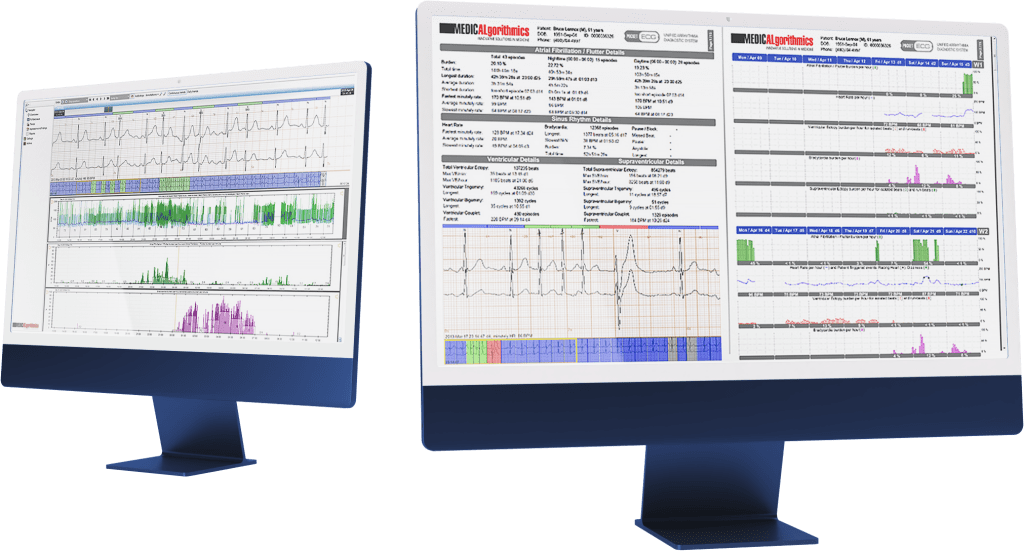

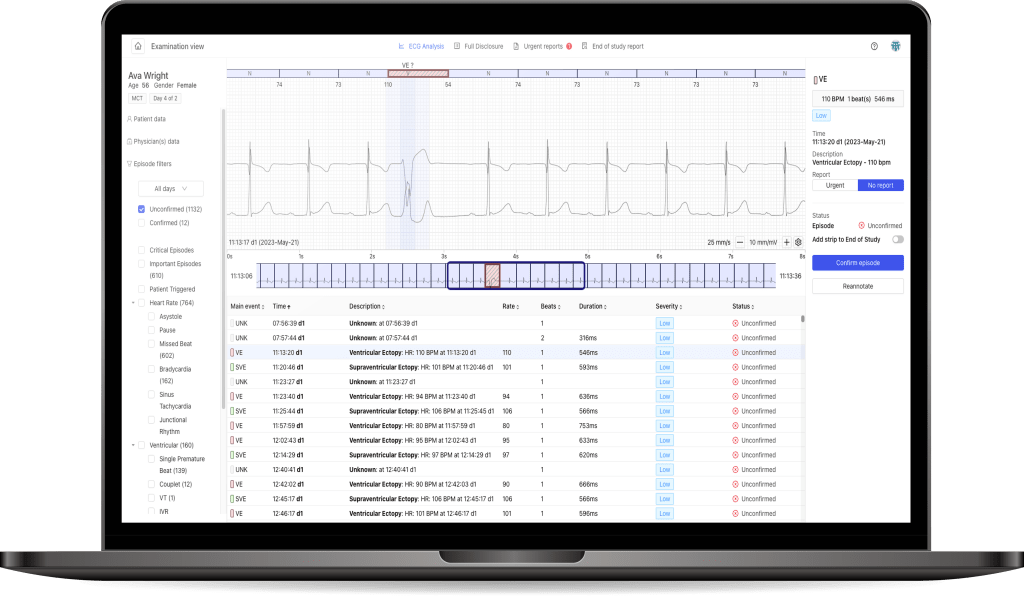

- Successful validation of the software platform compatibility with cardiac monitoring devices from five independent manufacturers. Consistent with Medicalgorithmics’ long history of cardiac monitoring leadership, these pilot projects were characterized by improved data insights, actionable physician reports, and significantly enhanced processing times.

- Dr. Linda Johnson, Chief Scientific Officer, showcased the capabilities of Medicalgorithmics’ DRAI (Deep Rhythm AI) product to predict atrial fibrillation based on arrhythmia data at the American College of Cardiology Conference in New Orleans. DRAI represents a technological and scientific breakthrough, responding to the important needs of practicing cardiologists worldwide.

- The Company’s PC Client software, including the AI-powered TechBot analytics add-ons, accurately identified 26 types of arrhythmias when utilized with the legacy monitoring hardware.

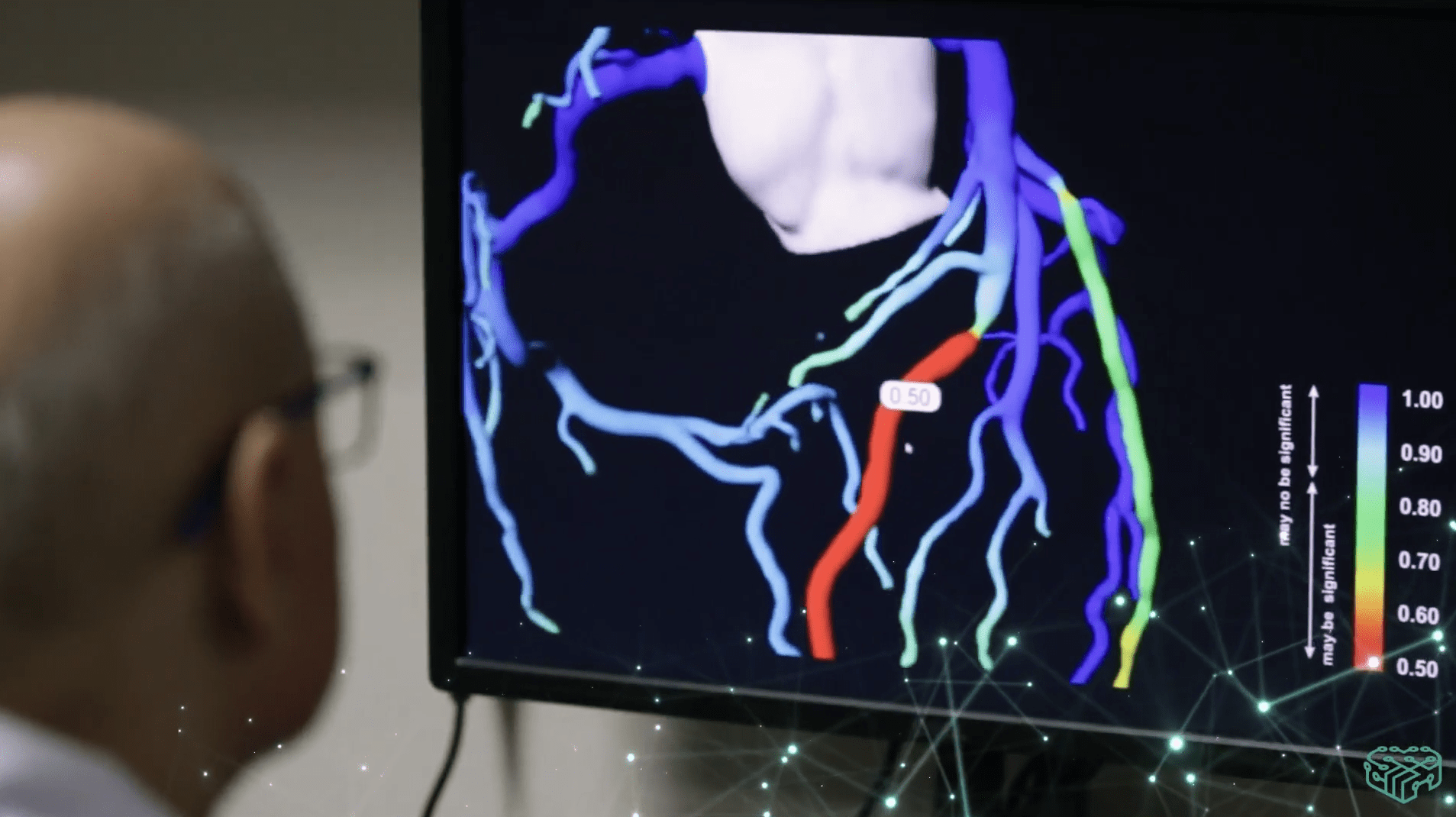

- The alpha launch of VCAST, Medicalgorithmics’ non-invasive CT scan-based coronary vessel blood flow analytics for myocardial infarction assessment and atherosclerotic plaque risk stratification (brought in by BioFund), received positive feedback from a select group of key opinion leaders.

Kris Siemionow, MD, Managing Partner of BioFund, stated, “Since acquiring our stake in Medicalgorithmics late last year, we are pleased with management’s progress in executing a strategic shift to focus on the software and analytics products, including leading edge AI technologies we have brought as part of the acquisition. The value of this best-in-class software, combined with the residual value of the legacy hardware business, and the development of the VCAST product line, positions MDG for sustained growth from a diversified revenue base. The incredible talent available in the Warsaw (Poland) labor market positions us well to further harness the power of AI to improve patient outcomes worldwide.”

First Quarter Consolidated Financial Results:

Revenue for the three months ended March 31, 2023 decreased by 13% year-over-year. While revenues from services remained consistent quarter-over-quarter, there was a 80% decline in the sale of monitoring devices (to PLN 0.5 million from 2.3 million in q1 2022), primarily due to the timing of hardware orders following the significant divestiture of Medi-Lynx (a contract that used to involve exclusivity clauses). However, monitoring session volume increased in eight of the twelve largest accounts.

Cash flows from operations amounted to PLN 3.0 million for the quarter, representing a significant improvement compared to the negative PLN 7.2 million in Q1 2022. The quarter’s EBITDA totaled PLN 2.8 million, resulting in a 25% margin. Net Income for the quarter amounted to a net profit of PLN 1.5 million, a significant improvement from PLN 55.4 million losses in Q1 2022.

With improved receivables collection, the divestiture of Medi-Lynx, and a capital contribution from the BioFund transaction, cash at hand increased from PLN 6.1 million to PLN 39.1 million. This improved liquidity substantially reduced operating risk on a year-over-year basis.

“The changes in revenues are a direct outcome of the strategic shift in the USA market during Q1 and the anticipated revenue decline as announced with the Medi-Lynx disposal. Renegotiating the exclusivity provision for the United States opens the world’s largest medical market for faster growth. The Company intends to leverage its robust balance sheet to finance our strategic shift. The focus on revenue diversification and attractive margins from software sales will better position the business,” said Maciej Gamrot, CFO of Medicalgorithmics. “The addition of senior sales leadership in both the North America (James Landis) and Europe (Cor Jungen) marks the beginning of our investment to build a commercial franchise, which the Company was previously unable to finance before the BioFund transaction,” Gamrot concluded.

About Medicalgorithmics, SA

Medicalgorithmics is a global healthcare technology company that leverages AI to revolutionize medical diagnostics worldwide. By harnessing the power of advanced analytics and innovative software solutions, Medicalgorithmics aims to improve patient outcomes and drive the transformation of the biometric market.