Medicalgorithmics, a MedTech company listed in the sWIG80 index, continues to successfully transform its business model in line with the objectives defined in its new development strategy adapted in June 2023. The company has secured several new, significant business partners, including three global leaders in modern cardiac diagnostics, with the goal of becoming their main provider of diagnostic software based on artificial intelligence algorithms.

“We are pleased with the progress we have made implementing Medicalgorithmics’ new development strategy announced in June of this year. As planned, our intensive efforts to acquire new business partners and build a diversified, global network of medical industry firms are yielding significant initial results. It’s a major accomplishment to have initiated cooperation with three global providers of diagnostic services and equipment, each offering substantial business potential, and with three new distributors in the USA, in such a short time. Due to the time needed for integration and evaluation of our software with partner systems, we expect revenue from these new contracts in the first half of next year. Despite the second half of this year and the first part of next year being transition periods for the company, as previously announced, we have achieved positive financial result, positive cash flow from operations, and a dynamic 22% year-over-year increase in global sales outside the USA, now accounting for over half of our revenues,” states Maciej Gamrot, Board Member for Finance at Medicalgorithmics.

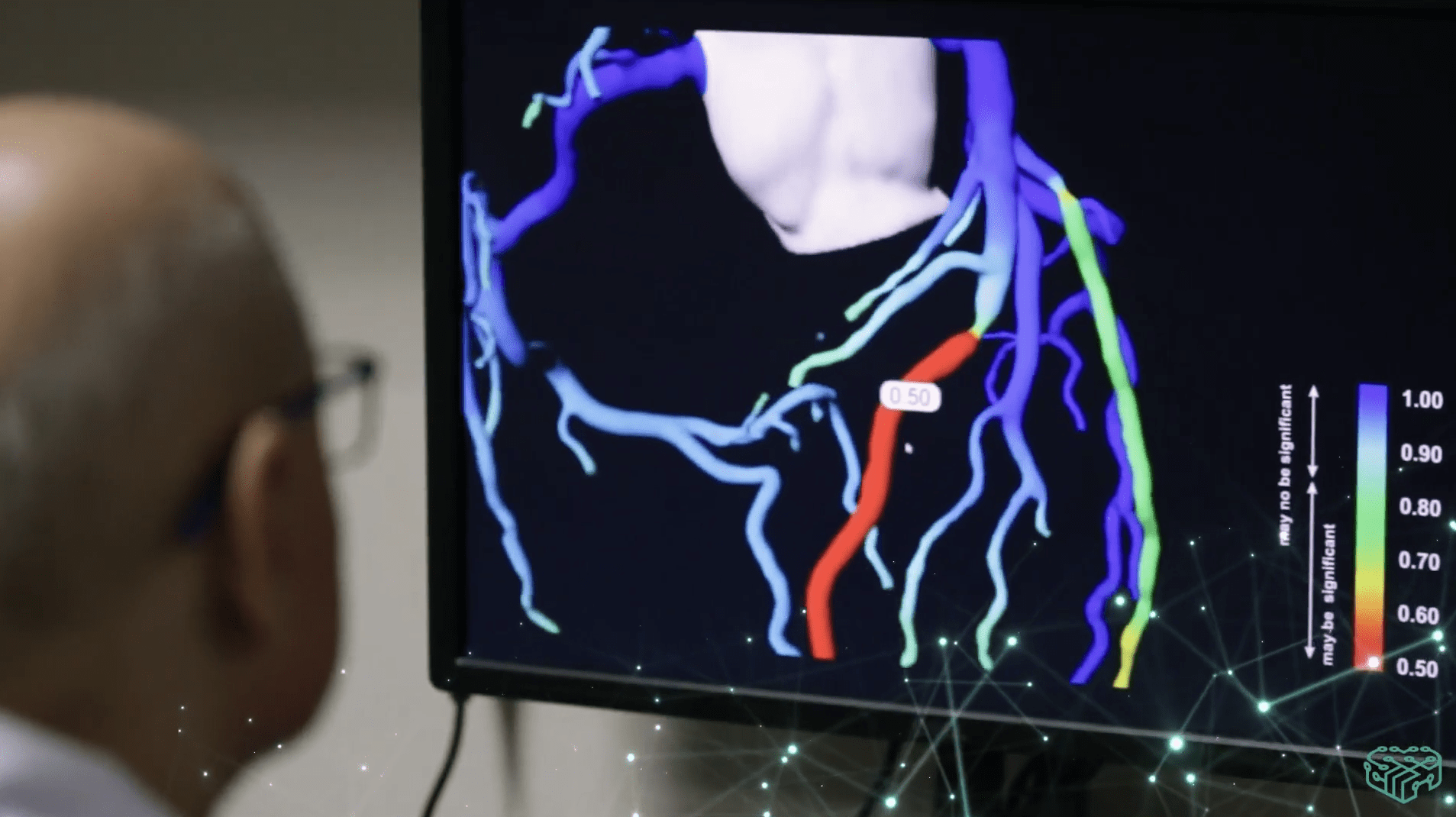

In line with its new strategy, Medicalgorithmics is finalizing its new product – VCAST, a medical system for non-invasive analysis of coronary vessels using artificial intelligence algorithms for coronary heart disease diagnostics. VCAST is a noninvasive test based on an inexpensive CT scan, that delivers in-depth analytics and critical clinical data that currently require highly invasive (surgical), and expensive hospital procedures. In October, the company started the CE certification process in the EU market, which is expected to be completed in the first quarter of 2024, and is preparing for the American market certification process in 2024. Medicalgorithmics has already secured its first major client for this new technology; in September, the medtech signed a letter of intent with the Polish company Grupa Diagnostyka to use VCAST for coronary disease diagnosis in the partner’s diagnostic facilities. Grupa Diagnostyka is the largest network of medical laboratories in Poland, conducting over 130 million tests annually. VCAST is being developed by Kardiolytics, a wholly-owned American subsidiary of Medicalgorithmics, acquired as part of Biofund’s strategic investment in December 2022.

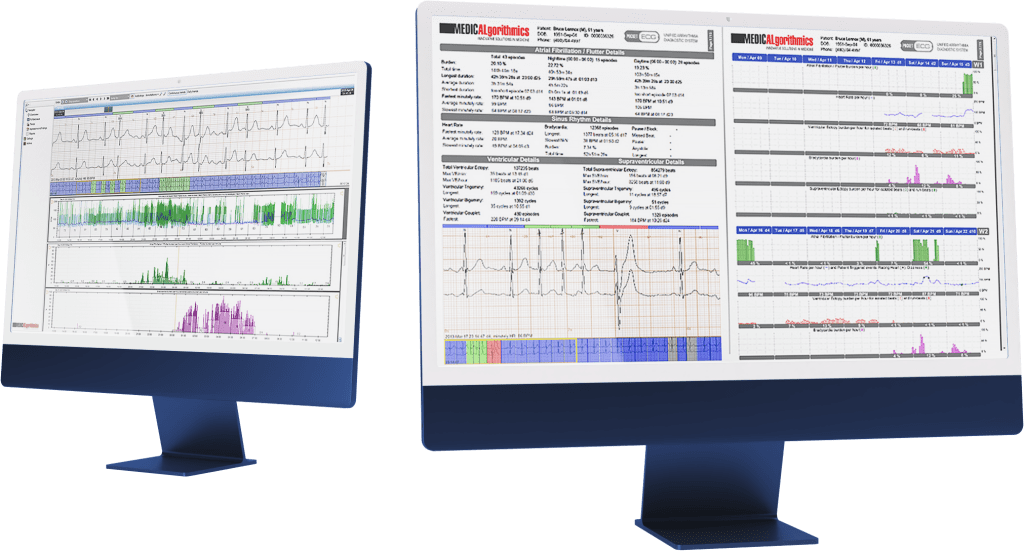

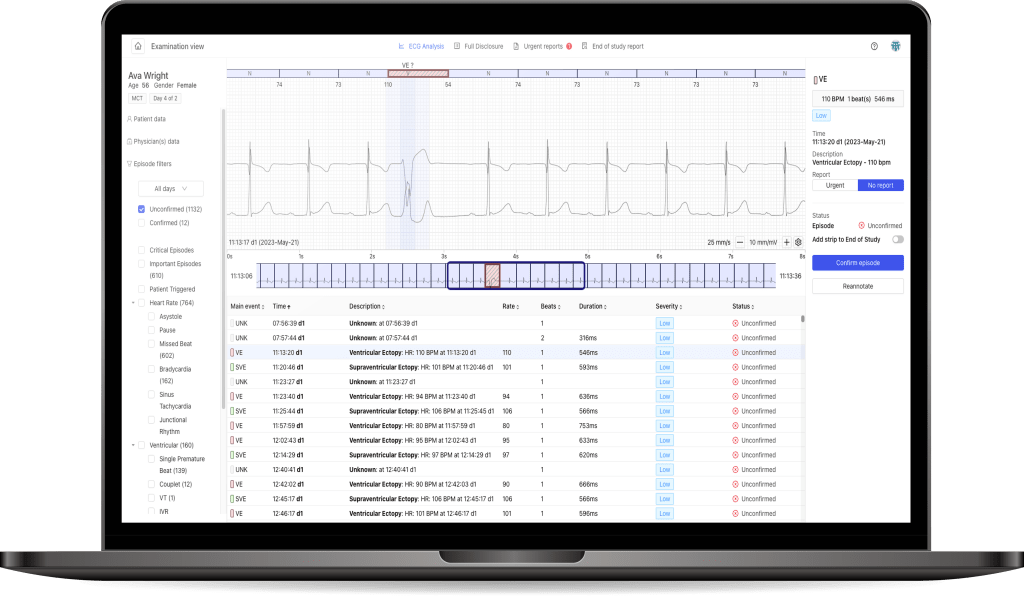

As part of the new strategy, new generations of AI software and EKG diagnostic products are also being developed. The Deep Rhythm Platform – a new generation PC Client based on the new DRAI algorithm, which received FDA certification in 2022, is currently in the EU/MDR and FDA certification processes.

From January to September this year, Medicalgorithmics reported a consolidated net profit of 0.1 million PLN compared to a loss of 21 million PLN the previous year. In the third quarter alone, the company recorded a consolidated net loss of 0,2 million PLN, an improvement over the second quarter.

The company’s individual results show profits at all levels of profitability for both the third quarter and the first three quarters cumulatively, with a net profit of 4.1 million PLN in the third quarter and 4.7 million PLN for the first three quarters cumulatively.

Consolidated revenues in the third quarter were over 9.5 million PLN compared to 9.7 million PLN in the second quarter and 17.4 million PLN last year. The Group’s year-on-year and quarterly sales decline is solely due to lower revenues in the U.S. market. Outside the U.S., the Group notes a 22% year-on-year and 21% quarter-on-quarter increase, offsetting the declines in the U.S. In the U.S., in line with the company’s strategic assumptions, the distribution model is being rebuilt to a network of distributors operating in a non-exclusive model. The company has already acquired 3 new Independent Diagnostic Testing Facilities (IDTFs) as distributors, replacing the previous one, with cooperation and revenues expected to continue until December this year. New distributors may generate revenue from the first quarter of next year, and as part of its strategy, the Group plans to acquire more each quarter.

After three quarters, global market sales generated 16.2 million PLN in revenue compared to 14.3 million PLN in the U.S., surpassing U.S. sales for the first time.

Medicalgorithmics also continued to develop global non-U.S. service sales, generating 4.3 million PLN in revenue in the third quarter compared to 4 million PLN in the same period last year.

The third quarter also saw a positive impact on sales from the announced second-quarter action of replacing partners’ heart monitoring devices with the new, fourth-generation PocketECG. Total equipment sales revenue in the third quarter was nearly 1.8 million PLN compared to 0.6 million PLN in the second quarter and last year. Investments by partners in equipment and renewed contracts, including with the largest partner in Canada, effectively bind them for the coming years, providing a foundation for continued sales growth in global markets outside the U.S.

The Group generates positive operational revenue of 0.8 million PLN and significantly increased its cash balance; as of the end of September 2023, the cash balance was 29.8 million PLN compared to nearly 12.8 million PLN last year. Equity increased to 93.9 million PLN compared to 15.1 million PLN in the same period last year.

In line with the new development strategy announced in June, created with the participation of Medicalgorithmics’ main shareholder Biofund Capital Management LLC, the company changed its business model. It moved away from offering a closed cardiac diagnostic system linked to its own heart monitoring devices. In its new strategy, it focuses on selling its EKG signal analysis system along with its proprietary AI system as a standalone product and its integration with partners’ devices and IT systems. Medicalgorithmics’ software is now available as a service, and the company will receive compensation in various models, including based on the number of EKG data analyses performed.

*End*

For additional information, please contact:

Investor Contact

Robert Mrozowski

InnerValue

r.mrozowski@innervalue.pl

+48 513 083 322

Contact for media

Mariusz Gawrychowski

InnerValue

m.gawrychowski@innervalue.pl

+48 501 520 598