Conclusion by the Issuer’s subsidiary of an agreement for the purchase of 25% of units in Medi-Lynx and setting forth the conditions for payment of a promissory note

Current Report No. 47/2020

Date: 31/12/2020

Legal basis: Article 17(1) of MAR – inside information

The Management Board of Medicalgorithmics S.A. (the “Issuer”, “Company”), hereby informs that on 31 December 2020, the Issuer’s subsidiary, Medicalgorithmics US Holding Corporation registered in the United States of America, (the “Buyer”), through which the Company owns 75% of units in Medi-Lynx Cardiac Monitoring, LLC (“Medi-Lynx”), concluded an agreement concerning the purchase of the remaining 25% of units in Medi-Lynx (the “Agreement”), previously beyond the Company’s control. The seller of units is Medi-Lynx Monitoring Inc. (the “Seller”), in which all the units are held by Mr. Andrew Bogdan. The parties, by way of negotiations, have set the purchase price for the 25% of units in Medi-Lynx (the “Purchase Price”) at USD 0.5m. In the concluded Agreement, the parties also agreed that after the transfer of ownership of the units the Buyer shall have no claims against the Seller with respect to existing liabilities of Medi-Lynx, including approximately USD 9.8 million of Medi-Lynx’s liabilities towards the Issuer (at the date of 30 November 2020), which, will be repaid according to recovered profitability in Medi-Lynx.

A part of the concluded Agreement is a compact concerning the terms of repayment of Medicalgorithmics US Holding Corporation’s liability on account of a promissory note towards the Seller (the “Promissory Note Liability”) in virtue of the acquisition of 75% of units in Medi-Lynx on 30 March 2016, the value of which as at 30 September 2020 was approximately USD 2 million plus accrued interest, with the Company informing of its negotiation in its Q3 2020 interim report. During the negotiations, the parties agreed that the Promissory Note Liability, together with the Purchase Price, will be paid by the Buyer in 48 monthly instalments.

At the same time, the parties resolved that the Agreement and the compact concerning the Purchase Price and the terms of repayment of the Promissory Note Liability exhaust mutual claims and settlements concerning the acquisition of control over Medi-Lynx.

From 31 December 2020, the Company will consolidate the financial result of Medi-Lynx in 100%.

Taking into account the price for 75% of the units acquired in 2016 and the Purchase Price, the total price of 100% of Medi-Lynx units was USD 34.6 million. Between the date of taking over control of Medi-Lynx until 30 September 2020, the Company received payments of approximately USD 34.6 million from Medi-Lynx for services rendered and goods supplied, and Medicalgorithmics US Holding Company received approximately USD 10.4 million in profit distribution from Medi-Lynx. As at 30 September 2020 Medi-Lynx had liabilities of USD 8.5 million towards the Issuer for services rendered and goods supplied. For the last 4 quarters, Medi-Lynx has posted revenues of USD 27.9 million.

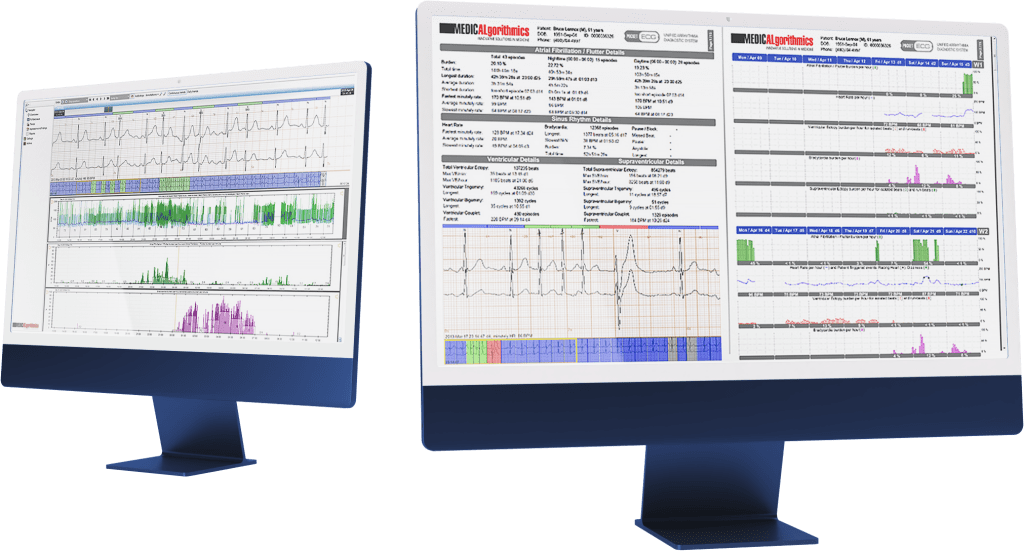

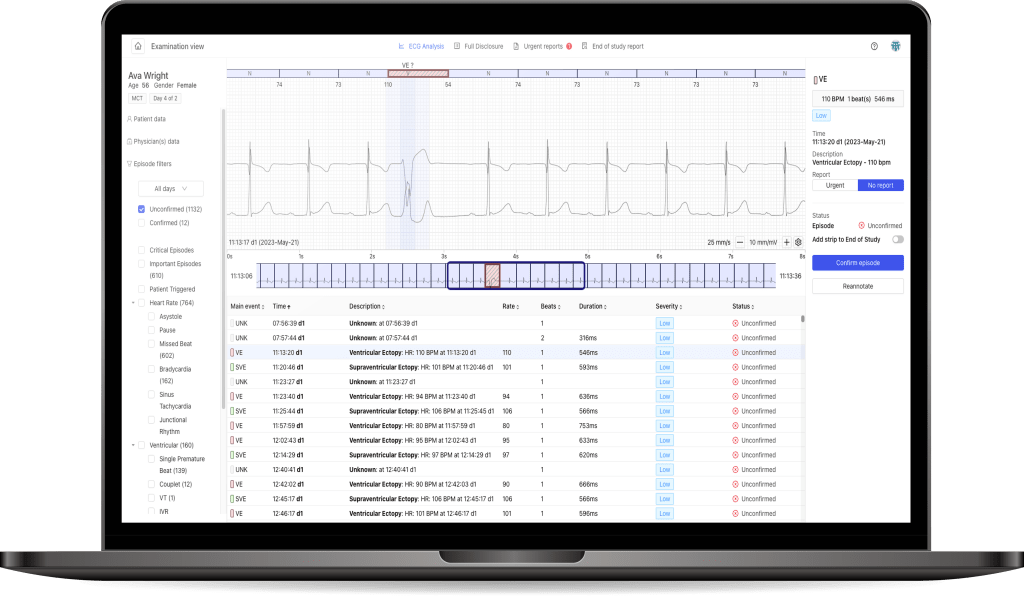

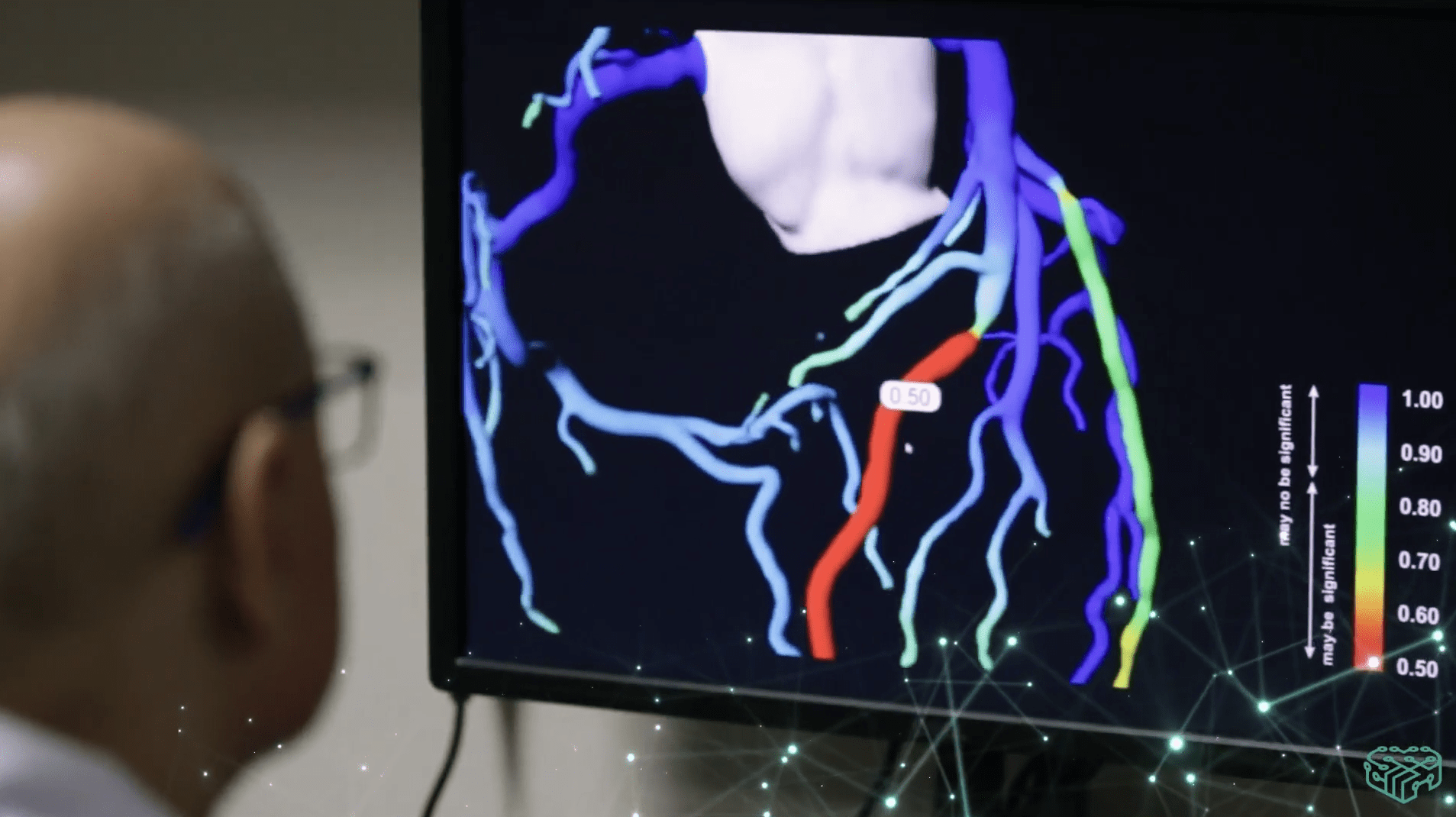

In the opinion of the Management Board, the acquisition of indirect control over 100% of the units in Medi-Lynx is in the best interest of the Company, giving the Company an opportunity to maximise the effects of changing its business model implemented in the last 24 months, and planning for 2021 commercialisation of new products and solutions. The Management Board believes that the total price paid for 100% of the units in Medi-Lynx is attractive in relation to the business opportunities obtained so far and in relation to the market shares in the USA and the revenues realised it is attractive on the basis of comparable transactions in the USA market.