Current Report No: 34/2023

Date: 25.11.2023

The Management Board of Medicalgorithmics S.A., based in Warsaw (“the Company”; “Issuer”), following the information provided about the provisional recognition of the fair values of acquired assets and liabilities assumed in the contribution of Kardiolytics Inc. (“Kardiolytics”) in accordance with IFRS requirements, as published in the Issuer’s current report no. 11/2023 dated April 21, 2023, hereby informs about the adoption of the final values of these assets and liabilities of Kardiolytics Inc. (“Kardiolytics”) in the consolidated financial statements of the Issuer’s Capital Group.

The Management Board reports that after conducting analyses related to the recognition of these values in the financial statements, with the support of the Company’s Supervisory Board and after discussions with the representatives of the auditor, it has decided to finally recognize them, in its opinion, in accordance with the most prudent and rigorous interpretation of IFRS Standards and IFRS, and the accounting resulting from the valuation is non-cash in nature.

In the current report no. 11/2023 (“Report”), the Company’s Management Board indicated that in the consolidated statement in accordance with paragraph 45 of IFRS 3, the Company applied a provisional settlement of the contribution in kind and plans to make a final settlement within 12 months from the date of the transaction to acquire 100% of the shares in Kardiolytics as a result of the agreement signed on November 8, 2022, providing for the issuance of 4,976,384 shares of the Company in exchange for a cash contribution of PLN 13.8 million and a contribution of 100% of the shares in Kardiolytics, in accordance with RB no. 66/2022 of November 16, 2022 (“Transaction”), i.e., until November 2023.

The Management Board of the Company informs that it adopts the estimated and provisionally accepted values in the consolidated financial statements of the Capital Group as of December 31, 2022, of the acquired assets and assumed liabilities and goodwill as final values, which amount to: the value of VCAST technology PLN 41.1 million, total assets PLN 41.6 million, liabilities PLN 9.8 million, net assets PLN 31.8 million, goodwill PLN 18.2 million. This approach means no valuation adjustments in the statements compared to the values reported as of December 31, 2022.

The Company explains that the indicated amounts and the manner of their presentation have been presented in accordance with the relevant international accounting standards (IFRS) concerning the accounting treatment of contributions in kind in this type of transaction and it is not an appraisal of the market value of the contribution.

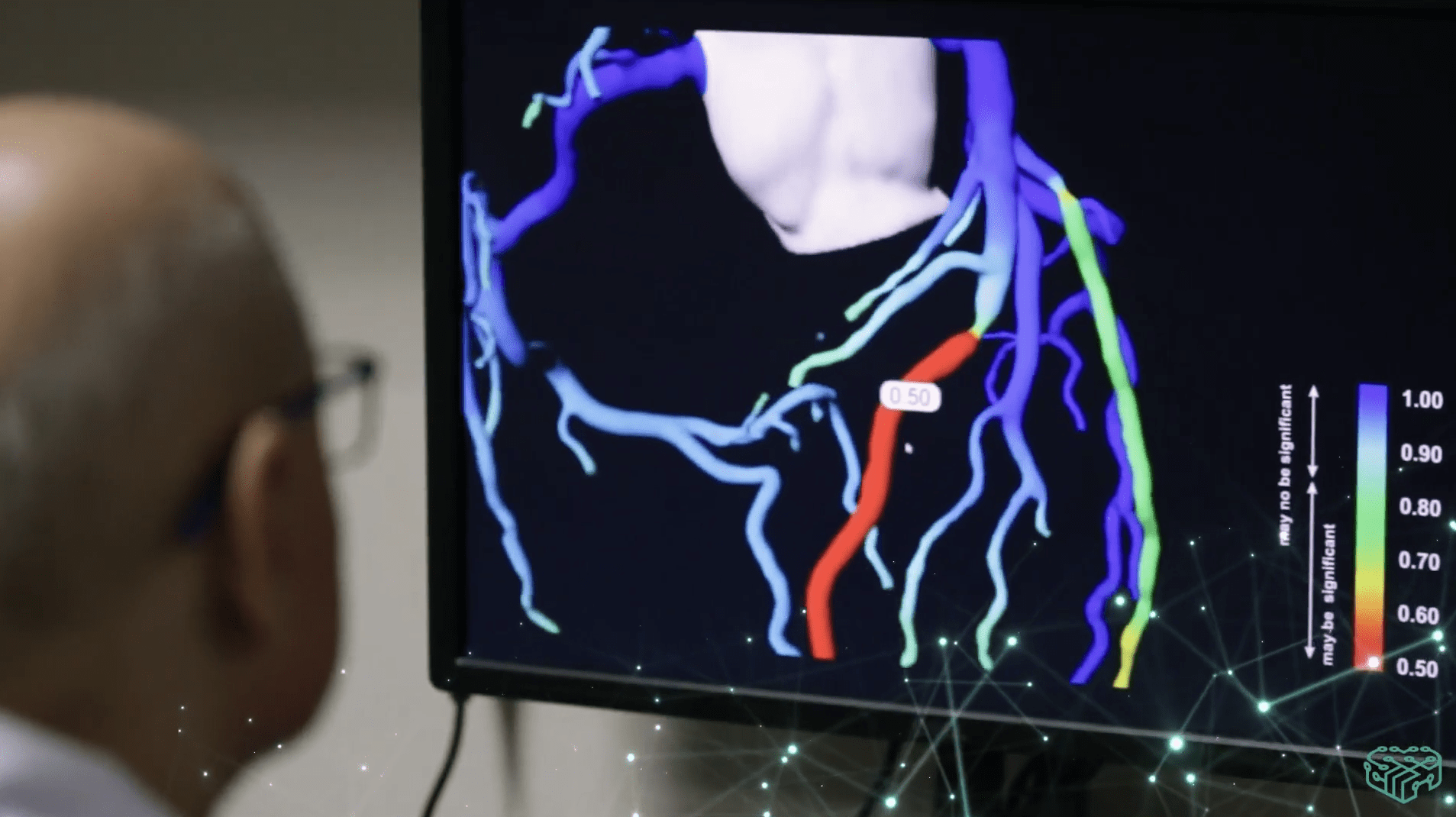

The Management Board recalls, according to the information in the Report, that the adjustments and changes in the values of assets and liabilities of Kardiolytics and equity resulting from the adopted approach, both in the individual and consolidated statements, are non-cash accounting entries resulting from the adoption of the most prudent interpretation of IFRS provisions and do not affect cash flows nor arise from an assessment of the development status of the VCAST technology based on artificial intelligence in Kardiolytics, nor its potential.

The Management Board reaffirms its previous assessment that the VCAST project in Kardiolytics is being implemented in accordance with the Company’s assumptions presented in the Issuer’s current reports, including, among others, obtaining another patent related to VCAST technology by Kardiolytics, according to RB no. 10/2023 of April 3, 2023, and the commencement of the EU/MDR certification process of this technology according to RB no. 27/2023 of October 3, 2023.